- 2018/09/09

- 7 min

-

1

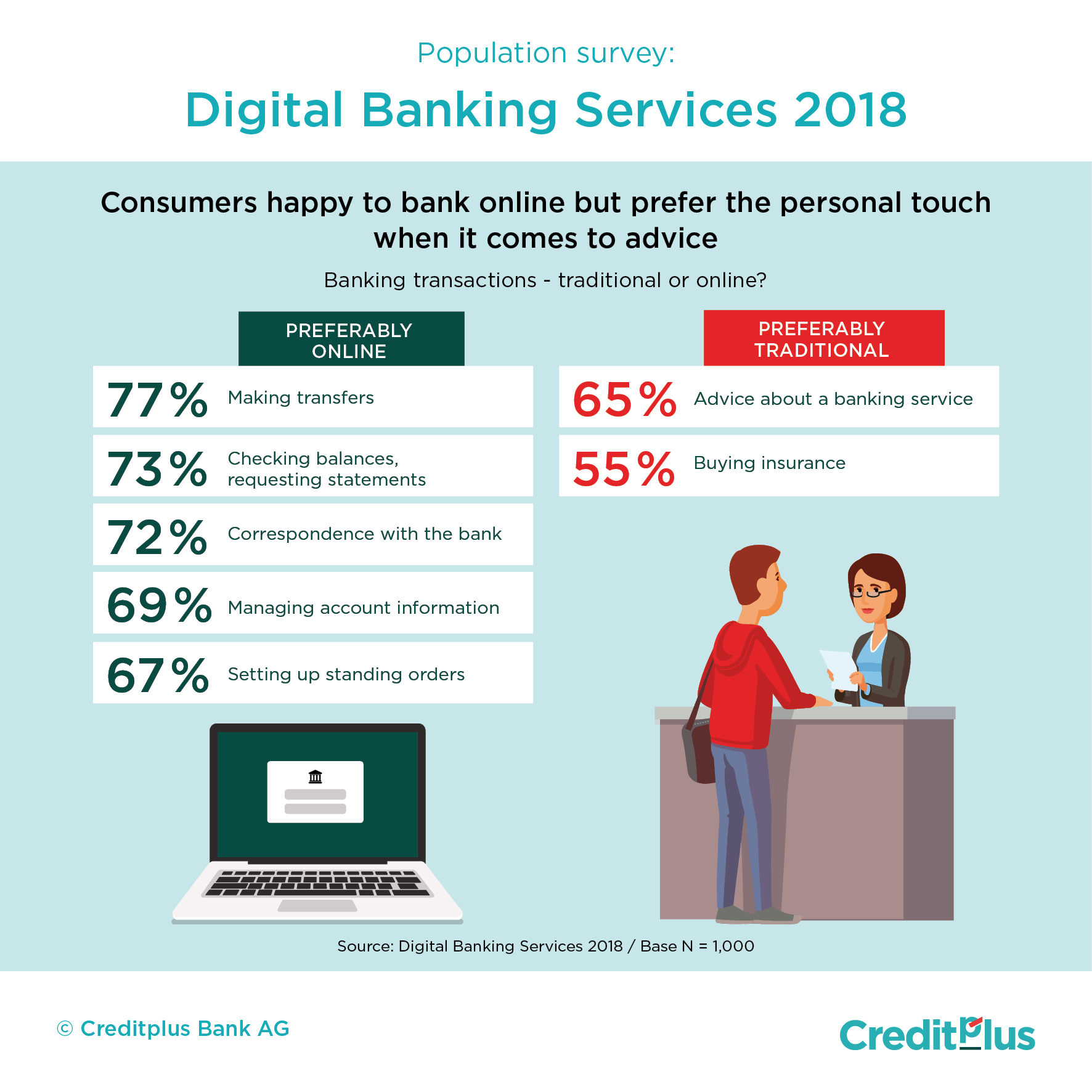

Customers happy to bank online but prefer the personal touch when it comes to advice

Advisers from the high street banks and traditional financial institutions are the most trusted source of advice. 74% feel most comfortable receiving personal advice from “their bank”, 59% say that they trust advisers from traditional financial institutions. 39% of those surveyed said they would trust the online advice tools of their high street bank, 32% would trust those offered by the traditional banks and just 19% said they would trust online advice from fintechs or start-ups.

Customers are most likely to trust their own bank

It’s a similar picture for trust in banking apps. Whilst 62% of Germans put their faith in the apps offered by their high street bank, most are wary of tools offered by third parties like fintechs and start-ups. Just 18% regard them in a positive way.

Video identification and digital signatures are gaining ground

Overall, most Germans have yet to embrace the different digital tools that they could be using to take care of their banking. However, there is a notable difference between generations.

45% of Germans aged 18 to 29 already use digital signature technology on their mobile phones and the figure for those aged 30 to 39 is as high as 49%. But for over 60s, it drops to just 19%. The figures for video identification, which saves customers a visit to the branch to open an account or take out a loan for example, tell a similar story. “We are seeing a steady rise in the use of these digital services too,” says Belgin Rudack, Chief Executive Officer of Creditplus Bank. “More and more customers use video-ident to identify themselves and sign a contract using a digital signature." The advantages are obvious: A trip to the post office is no longer necessary. The customer can take advantage of our services and products wherever he or she happens to be: at home, in a café or out shopping.

Contactless payment using NFC, where the customer pays by holding his or her card or mobile up to a reader, and fingerprint log-in for banking apps are already showing lots of potential. 42 percent of respondents already use these tools or at least intend to in the future.